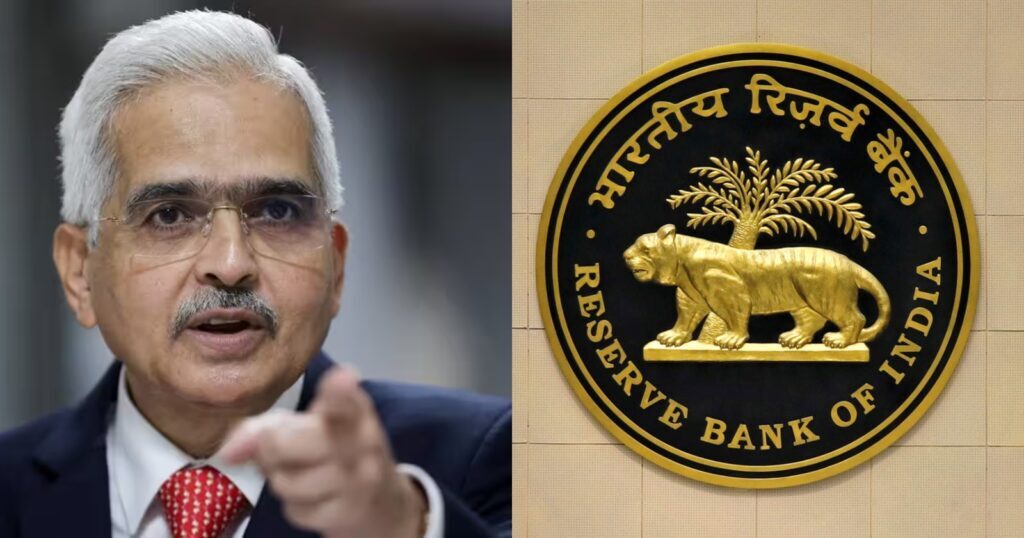

A viral message on WhatsApp claims that the Reserve Bank of India (RBI) has implemented a new cash deposit rule, pointing out that financial institutions with more than Rs 30,000 can be closed. This message is causing needless worry amongst bank account holders, but it is essential to clarify that this is entirely fake.

Table of Contents

RBI’s Stance on Cash Deposits

The RBI has not issued any new coin deposit regulations. You can maintain to deposit any sum of money into your financial institution account with no issues. However, it is vital to don’t forget the following RBI hints regarding cash deposits:

For savings debts, cash deposits exceeding Rs 10 lakh within a year must be suggested to the tax government.

There are no regulations on cash deposits into contemporary bills. However, you have to disclose all coin transactions at the same time as filing your ITR.

PIB Fact Check Confirms the Message’s Falsehood

The Press Information Bureau (PIB), the Government of India’s nodal agency for disseminating facts, has officially debunked the viral message. PIB has declared it faux and reiterated that RBI has not imposed this kind of restriction.

Cash Deposit Rule Myth: RBI Has Not Imposed

Reporting Fake Messages

n, PIB encourages individuals to report suspicious messages or information to fight the unfolding of incorrect information. You can go to their website, pib.Gov.In, or send the faux message to their WhatsApp quantity, 918799711259. PIB will confirm the authenticity of the statistics and provide correct updates.

Debunking the Cash Deposit Rule Myth: RBI Has Not Imposed Any New Restrictions

Stay Informed with Authentic Sources

In conclusion, the viral message claiming new RBI cash deposit regulations is wholly fabricated. Please depend upon respectable sources like the RBI website or PIB for accurate data and avoid falling prey to incorrect information.